AEPS Services

AADHAAR ENABLED PAYMENT SYSTEM (AEPS)

Aadhar AEPS is a bank led model which allows online interoperable financial transaction at PoS (Point of Sale / Micro ATM) through the Business Correspondent (BC)/Bank Mitra of any bank using the Aadhaar authentication.

AEPS India offers Aadhar Enabled Payment software & AEPS API integration services for Businesses all over India.

How to use AEPS?

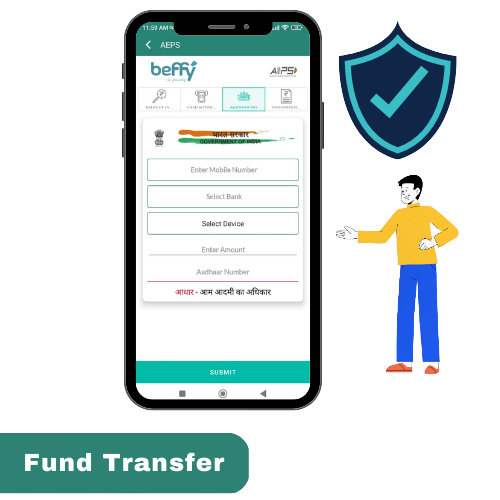

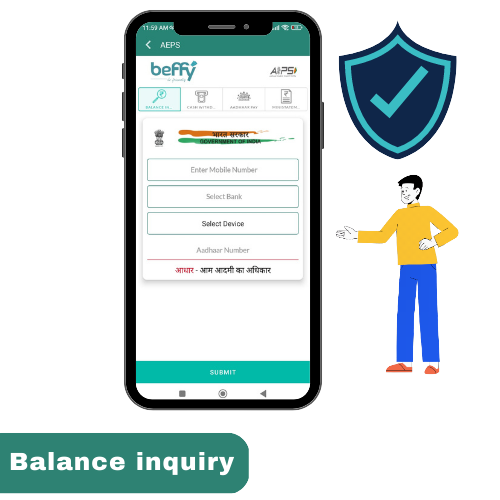

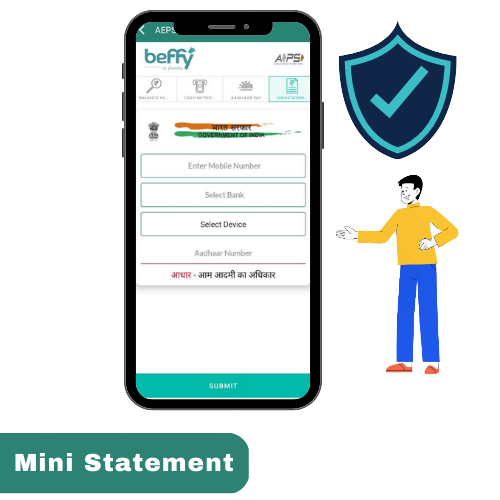

The user can perform the following using AEPS

- Step 1: Go to a micro ATM or banking correspondent

- Step 2: Provide Aadhaar number and bank name

- Step 3: Choose the type of transaction you want to make

- Step 4: Provide verification through fingerprint/iris scan

- Step 5: Collect your receipt

Service Benefits

Instant Service Activation

Earn upto ₹ 10,000 per month

Margins Instantly Credited

Choose from Variety of Bio-Metric Devices

Switch between Multiple Banks for AEPS

Withdrawal Limit between ₹100 - ₹10,000

Frequently Asked Questions - FAQ

Objective: - To serve the vulnerable. Expanding the State's Banking Services Infrastructure What is AEPS? biometric customer fingerprint authentication How does it work? Agents / Retailers use Payworld AEPS APP / PW after proper authorization. Withdrawal limit: - Rs - 10,000 for daily unlimited transactions * Mapped bank number for the scheme: - No service. 118 banks. (99% Bank Account Closed) Transaction Price:-

- AEPS stands for Aadhar Enabled Payment Systems and AEPS service providers specifically enable their customers to make payments using Aadhaar cards more securely and conveniently, why AEPS - A Great Business Opportunity?

- India, South Africa, China, etc. 2 Crore + Micro-ATM will be required to access such ATMs

- India, South Africa, China, etc. 2 Crore + Micro-ATM will be required to access such ATMs

- In the latest budget, the government proposes to give 6000/- to 14 Korean frames. The first installment of 2000 will be released in March.

- AEPS stands for Empowering Millions of Common Users and Entrepreneurs. Social security pension, NREGA Old Age pension etc. Most of the government schemes like

Beffy is the best AEPS portal and below are the steps to start your AEPS service:

- Purchase AEPS service: First, you need to visit the nearest Beffy Retail outlet and purchase AEPS service.

- Upload Required Documents: Individuals must provide their Aadhaar number which must be linked with the bank account of the AEPS service provider. Along with your Aadhaar number, you need to provide the name of the bank with which the Aadhaar is linked.

- Card device in service activation: After uploading all required documents, your fingerprint is taken by biometric device. The details are then sent to NPCI for verification.

- Card device in service activation: After uploading all required documents, your fingerprint is taken by biometric device. The details are then sent to NPCI for verification.

Secure Payment

Moving your card details to a much mote secured place

Trust Pay

100% Payment Protection. Easy Return Policy.

Refer & Earn

Invite a friends to sign up and & earn.

24/7 Support

We're here to help. Have a query and need help.