MATM Service

Beffy mATM Services

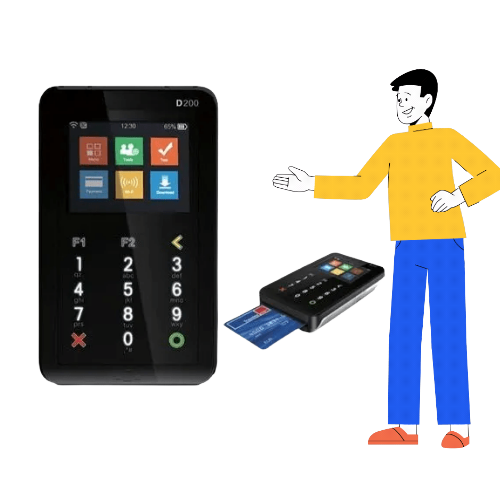

Beffy offers the best micro ATM services with software, mobile apps and micro ATMs. The best parts of micro ATMs are the highest cost for cash withdrawals, portable devices and ease of use. Micro ATM machines accept all bank cards and use biometrics for secure cash withdrawal transactions. Micro ATM, which is also called mini ATM. Unlike POS devices. The Micro-ATM solution enables bank correspondents (BCs) to perform basic banking services and financial transactions such as deposits, withdrawals, payments (transfer of funds), balance inquiries and small statements using biometric devices. Provide to customers. The platform allows business correspondents (who may own local Kirana stores) to make instant transactions.

How to work with Micro ATM

- Step 1: Insert your debit card or enter your registered mobile number. The first step to using a Micro ATM is to insert your debit card into the device or enter your registered mobile number linked to your bank account.

- Step 2: Select the type of transaction. Once your card or mobile number is verified, the Micro ATM will display a list of available transactions. Select the type of transaction you want to perform, such as cash withdrawal, balance inquiry, or fund transfer.

- Step 3: Enter the transaction amount Enter the amount you want to withdraw or transfer, or select a predefined amount from the options available on the screen.

- Step 4: Verify the transaction Verify the transaction details, including the amount and the account number, before proceeding.

- Step 5: Enter your PIN Enter your four-digit PIN to authenticate the transaction.

- Step 6: Collect your cash or transaction receipt Once the transaction is approved, the Micro ATM will dispense the requested amount of cash or provide a transaction receipt with details of the transaction.

Banks assign correspondents to register remote customers after verifying their identity with fingerprint or Aadhar no (fingerprint can be used as a means of authentication for local people). Fingerprints and personal information may also be linked to the Aadhaar card, which serves as proof of identity required for withdrawals.

To launch this portal, you need to complete the verification process like fingerprint scan or Aadhaar card with card swipe option. Once your identity is verified, you can choose from various transaction options such as cash deposits, direct debits, eKYC-based savings accounts, Aadhaar seeds, cash withdrawals, balance enquiries, and accepting service requests. To complete the transaction, just select the desired option, a message will appear on the screen and the receipt will be printed. After completing the transaction, as usual, you will receive a confirmation of the transaction via SMS from your bank.

Frequently Asked Questions - FAQ

A Micro ATM, also known as a mini ATM or a point of sale (POS) terminal, is a handheld device that allows individuals to perform basic financial transactions, such as withdrawing cash or checking their account balance, using a debit card or a mobile number linked to their bank account.

Micro ATMs are designed to provide basic financial services such as cash withdrawals, balance inquiries, fund transfers, and bill payments.

Anyone who has a debit card or a mobile number linked to their bank account can use a Micro ATM.

Secure Payment

Moving your card details to a much mote secured place

Trust Pay

100% Payment Protection. Easy Return Policy.

Refer & Earn

Invite a friends to sign up and & earn.

24/7 Support

We're here to help. Have a query and need help.